Personalized Financial Wellness: Sustainable Strategies for Stress Free Living

Understanding Your Current Financial Situation

Before you can chart a course toward financial wellness, you need a clear understanding of your current financial landscape. This involves meticulously reviewing your income, expenses, assets, and debts. Analyzing your bank statements, credit card bills, investment portfolios, and any outstanding loans will provide a comprehensive picture of your financial health. Identifying areas where you're overspending, or where you have unnecessary expenses, is crucial for developing effective strategies to achieve your financial goals. This self-assessment is the bedrock upon which your personalized financial plan will be built, ensuring that the strategies you implement are tailored to your specific needs and circumstances. Taking the time for this honest evaluation will pay dividends in the long run.

Detailed budgeting is key to understanding your spending habits. Categorize your expenses to pinpoint areas where you might be able to cut back or redirect funds. Are there recurring subscriptions or entertainment costs that you could potentially reduce or eliminate? This exercise helps you to visualize where your money is going and allows you to make conscious choices about your spending. A clear understanding of your current financial situation is not only important for setting goals but also for making informed decisions about your future financial well-being. This initial step is critical for long-term success.

Setting Realistic and Measurable Goals

Now that you have a good grasp of your current financial situation, it's time to define your financial wellness goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Instead of a vague aspiration like get out of debt, a SMART goal might be reduce credit card debt by $500 within the next three months. This specific, measurable goal provides a clear target and a timeline for achieving it. Having clear goals makes your financial journey more focused and helps you stay motivated along the way.

Consider your short-term and long-term financial objectives. Short-term goals might include paying down high-interest debt, building an emergency fund, or increasing savings. Long-term goals could involve buying a home, funding your children's education, or retiring comfortably. Breaking down your larger goals into smaller, more manageable steps will make the process less daunting and more achievable. This approach creates a roadmap towards a secure financial future.

Remember to prioritize your goals based on your individual circumstances and values. What matters most to you? This prioritization will ensure that you're focusing your efforts on the goals that are most important for your overall well-being.

Documenting these goals will serve as a powerful reminder of your aspirations and will help you stay motivated and on track. It's important to regularly review and adjust your goals as your financial situation evolves.

Debt Management Strategies: Taking Control of Your Financial Obligations

Understanding Your Debt

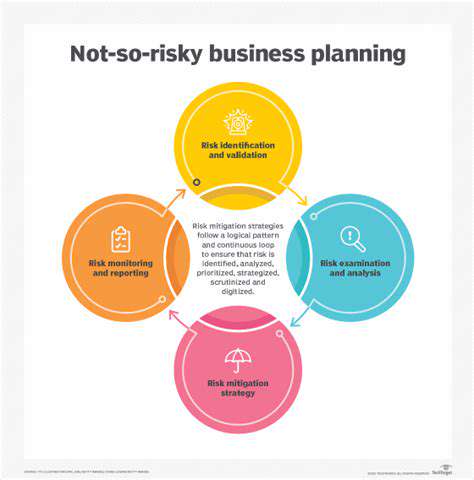

Debt management isn't just about paying off loans; it's about understanding your financial situation thoroughly. This includes identifying all your debts – credit cards, student loans, mortgages, personal loans, and any other outstanding obligations. Analyzing the interest rates and repayment terms of each debt is crucial for developing an effective strategy. Knowing the specifics of your debts empowers you to make informed decisions about how to tackle them.

Understanding your income and expenses is equally important. A detailed budget helps you identify areas where you can cut back on spending and allocate more funds towards debt repayment. Prioritizing needs over wants is key to achieving financial stability.

Creating a Debt Repayment Plan

A well-structured debt repayment plan is the cornerstone of effective debt management. This plan should outline the specific debts you'll tackle, the order in which you'll pay them off, and the timeframe for achieving your goals. Prioritize high-interest debts first to minimize the overall cost of borrowing. A realistic timeframe, while ambitious, should be achievable and motivating.

Consider factors like minimum payments, interest rates, and the potential for penalties or fees when creating your plan. Thorough research and careful planning are essential for success.

Utilizing Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a potentially lower interest rate. This can simplify your monthly payments and potentially reduce your overall interest burden. However, it's critical to compare interest rates and fees from different lenders before making a decision.

Debt consolidation can be a valuable tool, but it's not a guaranteed solution for everyone. Carefully weigh the pros and cons based on your specific financial situation.

Exploring Balance Transfers

Balance transfers can be a viable option for reducing your debt burden. These transfers move your existing credit card balances to a new card that offers a promotional 0% APR period. This allows you to make significant progress on your debt while saving money on interest during this promotional period. However, it's crucial to understand the terms and conditions, including the balance transfer fee and the subsequent interest rate after the promotional period ends.

Thoroughly research different balance transfer offers and compare the fees, APRs, and terms. Avoid high transfer fees or hidden charges that could negate the benefits.

Negotiating with Creditors

Sometimes, directly negotiating with your creditors can lead to more favorable repayment terms. This may involve reducing interest rates, extending repayment periods, or lowering minimum payments. Proactive communication with your creditors can often result in more manageable debt obligations. Be prepared to demonstrate your financial responsibility and commitment to repayment.

Seeking Professional Guidance

When facing complex debt situations, seeking professional guidance from a certified financial advisor or credit counselor can be invaluable. They can provide personalized advice tailored to your specific circumstances and help you develop a comprehensive debt management strategy. They can also offer insight into budgeting and spending habits, which can help you maintain financial stability.

Financial advisors can offer objective perspectives and support you in making informed decisions. They can also help you navigate the complexities of different debt management options.

Budgeting and Spending Habits

Effective debt management is intrinsically linked to sound budgeting and spending habits. A well-defined budget allows you to track your income and expenses, identify areas where you can cut back, and allocate more funds towards debt repayment. Regularly reviewing and adjusting your budget is essential to ensure it remains aligned with your financial goals.

Developing good spending habits and controlling impulsive purchases are crucial for long-term financial health. Creating a budget and sticking to it is the first step in taking control of your finances.

Investing for the Future: Growing Your Wealth with Purpose

Defining Your Financial Goals

Understanding your financial aspirations is crucial to creating a personalized investment strategy. Think about your short-term and long-term goals. Do you want to save for a down payment on a house, fund your child's education, or retire comfortably? Clearly articulating these objectives provides a roadmap for your investments, ensuring they align with your life's milestones and desired outcomes. This personalized approach allows you to tailor your investments to your unique circumstances and aspirations, maximizing your potential for future financial security.

Assessing Your Risk Tolerance

Every investor has a different comfort level with market fluctuations. Understanding your risk tolerance is paramount to choosing investments that align with your personality and financial situation. Are you comfortable with the possibility of significant short-term gains and losses, or do you prefer a more stable, lower-risk approach? A thorough assessment of your risk tolerance will guide your investment choices and help you avoid making decisions driven by fear or greed. This crucial step is essential for long-term financial well-being.

A personalized financial plan considers your current financial situation, including your income, expenses, debts, and assets. This careful evaluation allows for a tailored investment approach that prioritizes your individual circumstances and financial objectives.

Selecting Appropriate Investment Vehicles

Once you've defined your goals and assessed your risk tolerance, you can explore various investment vehicles. Consider options like stocks, bonds, mutual funds, ETFs, real estate, and alternative investments. Each vehicle carries its own level of risk and potential return. A professional financial advisor can help you navigate these choices, offering personalized recommendations based on your unique financial profile and goals. By carefully selecting appropriate vehicles, you can position yourself for sustained growth and achievement of your financial objectives.

Diversifying Your Portfolio

Diversification is a cornerstone of successful investing. By spreading your investments across different asset classes, you can mitigate risk and potentially enhance returns. A well-diversified portfolio can help to insulate your investments from significant losses during market downturns. This strategic approach allows you to balance risk and reward, ensuring a more stable and predictable investment journey. A diversified portfolio is not a one-size-fits-all solution; it's tailored to your specific risk tolerance and financial circumstances.

Seeking Professional Guidance

Navigating the complexities of the investment world can be challenging. Seeking professional guidance from a qualified financial advisor can be invaluable. A financial advisor can help you develop a personalized investment strategy aligned with your specific goals and risk tolerance. They can also provide ongoing support and adjustments as your financial circumstances evolve. Engaging with a professional advisor empowers you to make informed investment decisions, fostering a more confident and secure financial future.

Read more about Personalized Financial Wellness: Sustainable Strategies for Stress Free Living

Hot Recommendations

- AI Driven Personalized Sleep Training for Chronic Insomnia

- AI Driven Personalization for Sustainable Stress Management

- Your Personalized Guide to Overcoming Limiting Beliefs

- Understanding Gender Dysphoria and Mental Health Support

- The Power of Advocacy: Mental Health Initiatives Reshaping Society

- Building a Personalized Self Compassion Practice for Self Worth

- The Ethics of AI in Mental Wellness: What You Need to Know

- AI Driven Insights into Your Unique Stress Triggers for Personalized Management

- Beyond Awareness: Actionable Mental Health Initiatives for Lasting Impact

- Creating a Personalized Sleep Hygiene Plan for Shift Workers