Personalized Financial Wellness: Reducing Stress, Building Security

Understanding the Holistic Approach

True financial health extends far beyond mere account balances; it represents a comprehensive life strategy. Financial security emerges from intentional decision-making that harmonizes with personal values and life goals. This multidimensional perspective acknowledges the inseparable connection between fiscal responsibility and psychological stability. Effective financial planning must remain fluid, adjusting to life's unpredictable nature while providing stability during turbulent periods.

The pursuit of financial wellness represents an ongoing evolution rather than a fixed achievement. Regular evaluations of one's financial strategy ensure its continued relevance and effectiveness. This adaptive methodology permits necessary refinements as personal circumstances and economic landscapes shift over time.

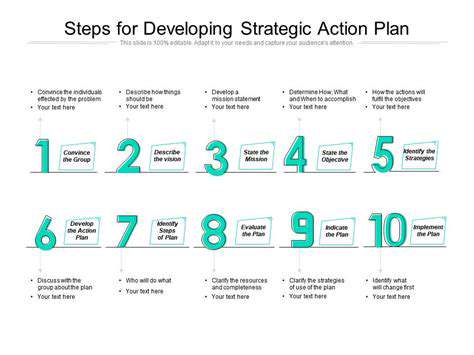

Building a Personalized Financial Plan

Constructing a customized financial roadmap forms the foundation of economic stability. This process demands careful consideration of individual circumstances, aspirations, and comfort with risk. Comprehensive assessment of earnings, expenditures, savings patterns, investment opportunities, and debt obligations creates the framework for meaningful progress toward financial objectives.

Managing Debt and Building Credit

Effective debt oversight represents a critical component of financial wellness. Strategic approaches to obligations - whether educational loans, credit card balances, or home mortgages - can prevent interest accumulation while enhancing creditworthiness. Techniques like targeted repayment schedules, careful budgeting, and potential debt restructuring can alleviate financial pressure while establishing a positive credit history.

Developing strong credit credentials facilitates access to housing, employment opportunities, and favorable loan terms. Consistent, timely payments and judicious credit utilization form the backbone of creditworthiness, significantly contributing to overall economic stability and future possibilities.

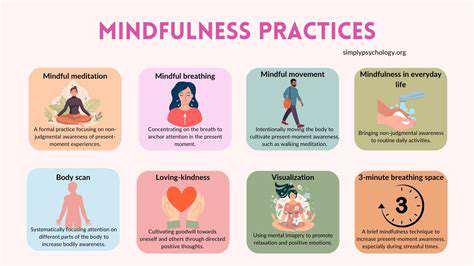

Cultivating Financial Literacy and Mindfulness

Financial education transcends basic arithmetic; it involves developing a nuanced understanding of economic principles and their practical applications. This encompasses budgeting techniques, investment strategies, savings methodologies, and debt management approaches. Continuous learning about financial matters proves essential for navigating today's complex economic environment.

Financial awareness involves scrutinizing spending patterns, recognizing potential savings opportunities, and making deliberate choices about resource allocation. This consciousness enables decisions that support both immediate needs and long-range aspirations, creating alignment between financial behaviors and personal values.

Crafting a Personalized Financial Plan: Tailoring Strategies for Success

Understanding Your Financial Needs

Developing an effective financial strategy begins with comprehensive assessment of current economic circumstances. This involves evaluating income sources, expenditure patterns, outstanding liabilities, and existing assets. Identifying potential areas for expenditure reduction creates opportunities for enhanced savings and financial flexibility. Clear comprehension of one's present financial position establishes the groundwork for realistic goal-setting.

Equally important is consideration of both immediate and distant objectives. Whether preparing for homeownership or planning retirement, clearly defined aspirations enable more effective resource allocation. This customized methodology ensures financial strategies remain tightly aligned with personal priorities.

Defining Your Financial Goals

With current circumstances understood, specific financial targets can be established. These might include saving for major purchases, creating emergency reserves, or preparing for retirement. Employing SMART (Specific, Measurable, Achievable, Relevant, Time-bound) criteria enhances goal clarity and progress tracking.

Contingency planning remains equally vital. Preparing for unexpected developments like employment changes or medical needs helps maintain stability during challenging periods. Proactive planning minimizes disruption when unforeseen circumstances arise.

Developing a Budget and Tracking Progress

A meticulously constructed budget serves as the operational framework for financial management. This tool facilitates intentional resource distribution across various needs and aspirations, while also highlighting spending habits requiring adjustment.

Regular budget reassessment proves essential as personal and economic conditions evolve. Consistent monitoring and necessary modifications promote sustained financial health and goal attainment. Financial plans demand ongoing attention rather than static implementation.

Seeking Professional Guidance and Resources

The complexity of financial planning often warrants expert consultation. Financial professionals can provide customized advice tailored to individual situations and ambitions, helping develop comprehensive strategies.

Additional resources including digital tools, educational programs, and reputable financial publications offer valuable insights. Leveraging these assets promotes informed decision-making and enhances financial capability. Knowledge transforms into practical advantage when applied effectively.

The late 1990s witnessed a transformative shift in travel planning as digital agencies emerged, revolutionizing price comparison capabilities. While technologically primitive compared to contemporary standards, these platforms introduced unprecedented transparency in travel pricing, democratizing information previously restricted to industry professionals. Early challenges - including cumbersome interfaces and consumer apprehension about online payments - ultimately gave rise to today's expansive travel industry.

Building a Financial Safety Net: Protecting Against the Unexpected

Understanding Your Financial Needs

Constructing reliable financial protection begins with detailed analysis of current economic conditions. This entails examining income streams, spending habits, and existing resources. Comprehensive budgeting reveals opportunities for strategic savings and more efficient resource allocation. Understanding both essential expenditures and discretionary spending patterns informs more effective financial planning.

Anticipating future requirements represents another critical consideration. Potential educational costs, healthcare needs, or retirement planning should influence safety net construction. Thorough understanding of both present and projected financial landscapes enables more robust protection strategies.

Establishing an Emergency Fund

The foundation of financial security lies in accessible emergency reserves. These funds should cover three to six months of living expenses, providing protection against unforeseen circumstances like unemployment or unexpected repairs. This financial buffer prevents crisis situations from derailing long-term economic stability.

Properly structured emergency funds reduce stress during challenging periods, allowing for measured responses without resorting to high-interest borrowing or compromising future plans.

Creating a Budget and Tracking Expenses

Detailed budgeting facilitates effective financial oversight by categorizing income and expenditures. This process highlights potential areas for reduction while establishing realistic savings targets. Consistent expenditure monitoring enables timely adjustments to maintain financial course.

Such systematic review promotes deeper understanding of spending behaviors and identifies improvement opportunities, leading to more informed financial decisions.

Exploring Savings and Investment Options

Beyond emergency reserves, various savings and investment vehicles merit consideration. Options range from high-yield deposit accounts to conservative investment instruments. Liquid savings address short-term needs while investments support long-term growth. Diversification across asset classes helps manage risk while building wealth.

Thorough research into available options and their respective risk profiles supports decisions aligned with personal financial objectives and risk tolerance.

Protecting Your Assets

Asset protection forms an essential component of comprehensive financial planning. Appropriate insurance coverage - including health, property, and life policies - mitigates potential financial impacts from unexpected events. Carefully evaluating coverage needs and policy options ensures adequate protection.

Managing Debt Effectively

Strategic debt management promotes financial stability. Prioritizing high-interest obligations while exploring consolidation opportunities can accelerate debt reduction. Thoughtful debt strategies free resources for savings and investment purposes.

Understanding various debt management approaches enables selection of solutions best suited to individual circumstances and financial goals.

Reviewing and Adapting Your Plan

Financial safety nets require periodic reassessment to maintain effectiveness. Changing personal circumstances, economic conditions, and financial objectives necessitate plan adjustments. Regular evaluation ensures continued alignment with current needs and future aspirations.

Staying informed about financial market developments enhances ability to adapt strategies as conditions evolve, promoting sustained financial health.

Read more about Personalized Financial Wellness: Reducing Stress, Building Security

Hot Recommendations

- AI Driven Personalized Sleep Training for Chronic Insomnia

- AI Driven Personalization for Sustainable Stress Management

- Your Personalized Guide to Overcoming Limiting Beliefs

- Understanding Gender Dysphoria and Mental Health Support

- The Power of Advocacy: Mental Health Initiatives Reshaping Society

- Building a Personalized Self Compassion Practice for Self Worth

- The Ethics of AI in Mental Wellness: What You Need to Know

- AI Driven Insights into Your Unique Stress Triggers for Personalized Management

- Beyond Awareness: Actionable Mental Health Initiatives for Lasting Impact

- Creating a Personalized Sleep Hygiene Plan for Shift Workers