Customized Financial Wellness Plans: Reducing Stress, Building Security

Defining Your Financial Wellness Journey

Understanding Your Current Financial Situation

Taking stock of where you stand financially forms the bedrock of any sound financial strategy. This requires examining every aspect of your monetary life - what comes in, what goes out, what you own, and what you owe. Grasping the ebb and flow of your income streams, whether steady or variable, proves absolutely vital when mapping out spending plans and future financial moves. Don't just consider your primary paycheck - factor in investment returns, freelance work, or any other money-making activities.

Equally crucial is dissecting your spending patterns. Break down expenses into clear categories to spot potential problem areas. Could certain monthly subscriptions or habitual purchases be trimmed? Pinpointing these often reveals surprising opportunities to build savings gradually.

Setting Practical Financial Targets

Clear financial objectives act as motivational anchors on your path to monetary health. These might include immediate aims like clearing store credit or ambitious, long-range plans such as accumulating a house deposit or securing retirement funds.

Well-defined goals function like financial GPS coordinates - they keep you oriented and moving forward. Without specific destinations, it's all too easy to drift financially. Let your core values guide which financial milestones matter most to you personally.

Budget Crafting and Adherence

A budget serves as your monetary game plan, directing income toward necessary expenses and savings targets. Thoughtful budget design helps monitor expenditures and reveals where to economize.

The magic lies in consistency - financial plans only work when followed faithfully. Budget discipline demands commitment. Remember to revisit and revise your budget whenever life circumstances shift significantly.

Cultivating Smart Spending Practices

Financial wellbeing hinges on developing mindful spending behaviors. This means making deliberate purchasing decisions, distinguishing essentials from luxuries, and resisting impulse buys.

Mastering the need-versus-want distinction forms the cornerstone of prudent money management. Cover necessities first, then allocate remaining funds to desires. This balanced approach helps maintain financial stability while preventing debt accumulation.

Handling Debt Strategically

Prudent debt management plays a pivotal role in financial wellness. For existing debts, devise and execute a systematic repayment strategy.

Target high-interest obligations first, formulating an aggressive payoff plan. Explore options like debt consolidation or balance transfers if they'll reduce interest costs. Recognize different debt types and their associated risks to manage them intelligently.

Establishing Financial Safety Nets

An emergency reserve forms the foundation of financial security. Accessible savings can cushion unexpected blows like unemployment or medical crises without derailing your financial trajectory.

Building this buffer demonstrates foresight and responsible money stewardship. Strive to accumulate three to six months' living expenses. This security blanket provides stability during difficult periods and significantly reduces financial anxiety.

Evaluating Your Present Financial Position

Income and Expenditure Analysis

The initial phase of financial assessment requires mapping all income sources and their predictability. Look beyond salaries to investment returns, side projects, or passive income streams. Categorize expenses carefully, separating must-haves like shelter and food from discretionary luxuries and entertainment. This breakdown reveals potential overspending and areas for sensible reductions.

Meticulous expense tracking, whether through apps or spreadsheets, illuminates spending behaviors. Regular reviews uncover patterns and adjustment opportunities. The critical skill here involves distinguishing essential expenditures from optional ones, enabling smarter financial prioritization.

Debt Portfolio Examination

Taking stock of existing debts is fundamental for holistic financial planning. Identify all obligations - credit cards, education loans, mortgages, or personal loans. Interest rates dramatically influence financial health, so understanding loan terms becomes crucial for developing repayment strategies.

Scrutinize minimum payments, interest rates, and potential penalties for each debt. Focus first on high-interest obligations when creating payoff plans. Consider options like debt consolidation or balance transfers to simplify repayment processes.

Savings and Investment Review

Assessing current savings and investments provides vital financial health indicators. Evaluate all savings vehicles - checking accounts, regular savings, high-yield options. Examine investment holdings including equities, fixed-income securities, and funds. Understanding risk-return profiles informs better financial decision-making.

Analyze portfolio diversification relative to your risk tolerance. Review historical performance while considering future growth potential during this assessment phase.

Asset and Liability Assessment

Complete financial evaluation requires cataloging assets (property, vehicles, valuables) against liabilities (outstanding debts and obligations).

Comparing total asset values against debt balances reveals net worth. Precise valuation of both elements provides an accurate financial snapshot. This asset-liability ratio informs strategic financial choices.

Insurance Coverage Audit

Review all insurance policies - health, life, property, automobile. Verify coverage adequacy for current needs.

Assess policy cost-effectiveness. Identify coverage gaps and explore alternative options to ensure comprehensive protection.

Future Goal Alignment

Financial plans should reflect life aspirations - retirement, education funding, major purchases. Understanding long-term financial requirements enables customized planning.

Estimating future goal costs facilitates realistic strategy development, creating a financial roadmap tailored to your ambitions.

Existing Plan Evaluation

If you have current financial strategies, assess their continued relevance. Outdated plans may require modification or complete replacement, particularly investment approaches and insurance coverage.

Analyzing past financial performance yields insights for future planning improvements, ensuring alignment with evolving circumstances and objectives.

Establishing Achievable Financial Targets

Comprehensive Financial Assessment

Begin by thoroughly evaluating your current financial standing before setting objectives. Examine income streams, spending patterns, assets, and liabilities methodically. Detailed budgeting exposes potential savings opportunities. This financial baseline enables progress measurement and informed decision-making regarding future financial moves.

Document all earnings - salaries, investment income, miscellaneous revenue streams. Similarly, track every expenditure, fixed or variable. Categorizing spending into essentials, non-essentials, and discretionary purchases helps identify reduction targets.

Priority Identification

Determine short- and long-term financial priorities to personalize your plan. Whether saving for property, eliminating debt, funding education, or preparing for retirement, clear priorities guide resource allocation.

Quantifiable Goal Setting

Avoid vague targets like save more. Instead, establish measurable goals with specific amounts and deadlines - Save $5,000 for a house deposit within 12 months works better than general intentions. Concrete objectives facilitate tracking and sustain motivation.

Practical Budget Development

Budgets function as financial roadmaps, organizing income and expenses to monitor cash flow and identify savings potential. Effective budgets needn't be complex - find a system that suits your lifestyle. Incorporate both fixed and variable expenses while allowing flexibility. Understanding spending habits ensures budget alignment with financial aspirations.

Savings and Investment Approaches

With priorities and budgets established, implement savings and investment tactics. Consider high-yield savings accounts or CDs for short-term goals. For longer horizons, explore stocks, bonds, or mutual funds. Portfolio diversification manages risk while maximizing returns. Professional financial advice can provide personalized guidance.

Strategic Debt Management

High-interest debt like credit card balances significantly impacts financial health. Develop structured repayment plans using methods like debt snowball or avalanche approaches. Understanding various debt types and associated rates informs effective management strategies. Commitment to repayment plans is essential for reducing financial burdens and achieving goals.

Regular Progress Reviews

Financial plans require periodic reassessment as circumstances evolve. Life changes - career moves, marriage, parenthood - necessitate financial plan adjustments. Modify budgets, objectives, and investment strategies accordingly. Don't hesitate to consult financial professionals when adapting your plan.

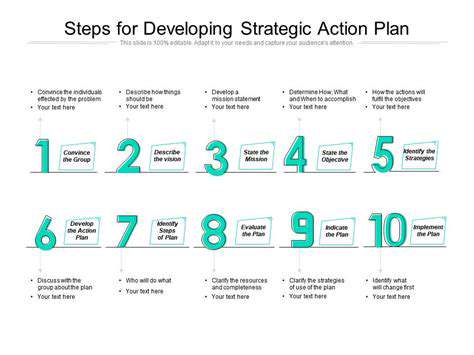

Formulating a Strategic Financial Blueprint

Scope and Objective Definition

Effective financial blueprints begin with clearly outlined parameters and aims. Precise objectives serve as navigational beacons, guiding decisions and ensuring all efforts contribute toward overarching financial visions. Establishing boundaries prevents mission creep and ensures optimal resource allocation.

Implement SMART (Specific, Measurable, Achievable, Relevant, Time-bound) key performance indicators to monitor progress. Quantifiable targets simplify evaluation and facilitate necessary adjustments during implementation.

Stakeholder Identification

Recognize all individuals or entities impacted by or involved in your financial plan. Thorough stakeholder analysis anticipates challenges and builds support networks crucial for successful execution.

Situational and Resource Analysis

Conduct comprehensive SWOT (Strengths, Weaknesses, Opportunities, Threats) assessments before finalizing plans. Evaluate all available resources - financial, human, technological - to ensure practicality. Early identification of limitations prevents future obstacles during implementation phases.

Strategy and Tactical Planning

Outline specific approaches and actions to achieve financial objectives. Clearly defined roles and responsibilities ensure effective execution, including task assignments, timelines, and resource distribution.

Timeline and Budget Development

Create realistic schedules marking key milestones and dependencies. Careful financial planning prevents cost overruns, ensuring sufficient funding for each initiative within specified timeframes.

Performance Monitoring

Implement robust tracking systems to evaluate progress against established KPIs. Regular assessments identify necessary adjustments, enabling course corrections that enhance success probabilities. Continuous monitoring also reveals unexpected challenges and opportunities, promoting adaptability.

Read more about Customized Financial Wellness Plans: Reducing Stress, Building Security

Hot Recommendations

- AI Driven Personalized Sleep Training for Chronic Insomnia

- AI Driven Personalization for Sustainable Stress Management

- Your Personalized Guide to Overcoming Limiting Beliefs

- Understanding Gender Dysphoria and Mental Health Support

- The Power of Advocacy: Mental Health Initiatives Reshaping Society

- Building a Personalized Self Compassion Practice for Self Worth

- The Ethics of AI in Mental Wellness: What You Need to Know

- AI Driven Insights into Your Unique Stress Triggers for Personalized Management

- Beyond Awareness: Actionable Mental Health Initiatives for Lasting Impact

- Creating a Personalized Sleep Hygiene Plan for Shift Workers