Personalized Financial Wellness: Strategies for Reducing Money Stress

Identifying Your Unique Financial Landscape

Understanding Your Income and Expenses

A critical first step in personal financial wellness is a thorough understanding of your income and expenses. This involves more than just knowing your salary; it encompasses all sources of revenue, including investments, side hustles, and any other financial inflows. Detailed tracking of all expenses, both fixed and variable, is essential. This includes not just rent or mortgage payments and utilities, but also smaller, seemingly insignificant costs like coffee, entertainment, and subscriptions. By meticulously recording every dollar spent, you gain valuable insights into spending patterns and areas where potential savings can be identified.

Categorizing expenses can further illuminate your financial picture. Grouping similar expenses together, such as dining out, transportation, or entertainment, allows for a more holistic view of spending habits. Identifying recurring expenses and infrequent but significant costs helps in creating a realistic budget and making informed financial decisions.

Assessing Your Assets and Liabilities

Evaluating your assets and liabilities is crucial for understanding your overall financial standing. Assets represent anything of monetary value you own, including savings accounts, investments, property, vehicles, and personal belongings. A comprehensive assessment should include the current market value of these assets, as well as their potential future worth. This step helps you understand the current net worth and potential for growth.

Conversely, liabilities represent your financial obligations, such as loans, credit card debt, mortgages, and outstanding bills. A clear understanding of your liabilities is vital for developing a strategy to manage and reduce debt. Analyzing the interest rates and repayment terms associated with each liability is essential to create a plan for debt reduction and financial freedom.

Analyzing Your Debt Management Strategies

Debt management is a significant component of personal financial wellness. Assessing your current debt situation, including the types of debts (e.g., credit card, student loans, mortgages), amounts owed, interest rates, and repayment schedules is essential. Understanding these details helps in developing targeted strategies for debt reduction, including budgeting, prioritizing payments, and potentially exploring debt consolidation or balance transfer options.

Evaluating different debt management strategies, such as the debt snowball or debt avalanche methods, can help determine the most effective approach for your specific financial situation. This includes considering the potential impact on your credit score and long-term financial goals. Furthermore, exploring options like negotiating lower interest rates or utilizing debt management programs can contribute to a more sustainable financial future.

Defining Your Financial Goals and Priorities

Clearly defining your financial goals and priorities is the cornerstone of a personalized financial wellness strategy. These goals could range from short-term objectives like saving for a vacation or a down payment on a house to long-term aspirations such as retirement planning or funding your children's education. It's important to be specific about your goals, including the desired amount, timeline, and potential challenges.

Prioritizing these goals is equally important. Some goals might be more urgent or have a higher impact on your overall financial well-being. Understanding these priorities allows for the development of a tailored financial plan that addresses your needs and aspirations effectively. This involves understanding your risk tolerance and aligning your investments and savings strategies with your long-term vision. This allows you to make informed decisions about your financial future, ensuring that your goals remain achievable.

Developing a Realistic Budget and Spending Plan

Understanding Your Income and Expenses

A crucial first step in developing a realistic budget is a thorough understanding of your income and expenses. This involves meticulously tracking all sources of income, from your salary to any side hustles or investment earnings. Accurate income tracking is essential for determining your available funds and for making informed spending decisions. Furthermore, meticulously documenting all outgoing expenses, both fixed and variable, is vital. This includes not only rent or mortgage payments, utilities, and groceries, but also smaller, seemingly insignificant expenses that can quickly add up, like coffee, takeout, and entertainment.

Categorizing expenses helps you identify areas where you might be overspending. For example, if you notice a significant portion of your income is going towards dining out, you can explore alternatives like cooking at home more often. Understanding these patterns is key to making informed adjustments and achieving your financial goals.

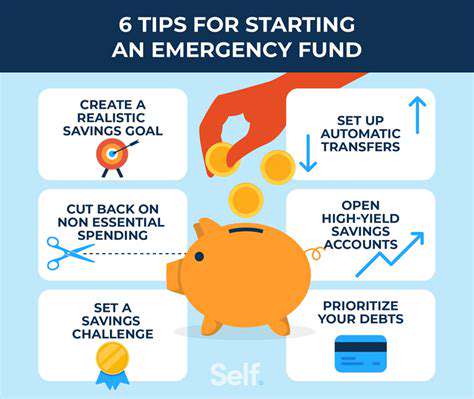

Setting Realistic Financial Goals

Establishing clear and attainable financial goals is fundamental to a successful budget. Whether it's saving for a down payment on a house, paying off debt, or building an emergency fund, defining these goals provides direction and motivation. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, instead of simply 'save money,' a SMART goal would be 'save $500 for a down payment on a new laptop by the end of the year.'

Having concrete goals keeps you focused on the bigger picture and helps you stay accountable for your financial decisions. Regular review and adjustments to your goals as circumstances change are essential, ensuring that your budget remains aligned with your evolving aspirations.

Creating a Detailed Budget Template

A well-structured budget template is a powerful tool for organizing your finances. It should include categories for all your income sources and expense types. This template should be tailored to your specific needs and circumstances. Consider using spreadsheet software or dedicated budgeting apps to create and maintain your template. These tools often offer features like automated calculations and expense tracking, making budgeting more efficient and user-friendly.

This structured approach provides a clear overview of your financial inflows and outflows, allowing you to monitor your progress towards your goals and identify any potential areas for improvement. This detailed view makes adjustments and refinements far easier to implement.

Prioritizing Needs Over Wants

Distinguishing between essential needs and discretionary wants is crucial for effective budgeting. Needs are the necessities for survival and basic comfort, such as housing, food, and healthcare. Wants, on the other hand, are items or experiences that enhance your quality of life but are not essential. Understanding this difference helps you allocate funds accordingly. Prioritizing needs over wants allows you to build a stable financial foundation before indulging in non-essential purchases.

Tracking and Monitoring Your Progress

Regularly tracking your spending and income helps you stay on top of your budget. Use your chosen budgeting method, whether it's a spreadsheet, an app, or a notebook, to meticulously record every transaction. This practice helps you identify any areas where you might be overspending and enables you to make necessary adjustments to stay on track. Regular review of your budget allows you to make necessary changes, ensuring you're always moving towards your financial goals.

Regular monitoring of your progress allows for flexibility and adjustment, so the budget remains relevant and effective. This is crucial for adapting to life changes and maintaining a healthy financial outlook.

Making Necessary Adjustments to Your Plan

Life circumstances frequently change, requiring adjustments to your budget and spending plan. Unexpected expenses, promotions, or job changes can all affect your financial situation. Regularly reviewing and adjusting your budget ensures it remains aligned with your current circumstances. This involves re-evaluating your income, expenses, and financial goals, and making necessary modifications to your budgeting strategy.

Flexibility is key to maintaining a healthy financial life. Being prepared to adjust your plan as needed demonstrates resilience and proactive financial management. This will help you avoid financial stress and maintain a positive financial outlook.

Managing Debt Effectively and Strategically

Understanding Your Debt Landscape

A crucial first step in managing debt effectively is understanding the full extent of your financial obligations. This involves meticulously cataloging all debts, including credit card balances, loans (personal, student, mortgages), and any outstanding bills. Analyzing each debt's interest rate, minimum payment, and repayment schedule is essential to developing a personalized strategy for tackling it.

Once you have a clear picture of your debt, you can begin to prioritize and categorize these obligations. This allows you to identify high-interest debts that should be targeted first and assess the overall financial strain your debt burden places on your budget.

Prioritizing High-Interest Debts

High-interest debts, such as credit cards with variable interest rates, typically accumulate interest rapidly. Addressing these debts first can significantly reduce the overall cost of your borrowing and accelerate your path toward financial freedom. Strategies for prioritizing high-interest debts often involve creating a plan to pay more than the minimum payment on these debts, utilizing debt consolidation or balance transfer options, or exploring other debt management tools.

Exploring Debt Consolidation Options

Debt consolidation involves combining multiple debts into a single loan with a potentially lower interest rate. This can simplify monthly payments and make managing your finances more manageable. However, it's critical to carefully assess the terms of any consolidation loan, including the interest rate, repayment period, and any associated fees. Thorough research and comparison shopping are essential before making a decision.

Utilizing Balance Transfer Cards Strategically

Balance transfer credit cards can be a useful tool for reducing the interest you pay on existing debts. These cards often offer a promotional period with zero interest, allowing you to pay off existing balances without accruing interest during this period. However, it's crucial to understand the terms and conditions, including the transfer fee and the subsequent interest rate after the promotional period expires. Carefully weigh the potential benefits against the potential drawbacks before applying.

Creating a Realistic Budget

A well-defined budget is the bedrock of effective debt management. It allows you to track your income and expenses, identify areas where you can cut back, and allocate resources towards debt repayment. Developing a realistic budget that accounts for all your financial obligations and personal needs is crucial for sustainable debt reduction. This process often involves meticulous tracking of expenses, identification of areas for potential savings, and careful allocation of funds to debt repayment.

Developing a Debt Repayment Plan

Once you've established a budget and prioritized your debts, it's time to develop a comprehensive repayment plan. This plan should outline specific targets for debt reduction, detailing how much you'll aim to pay each month. Consider using a debt snowball or debt avalanche method to motivate yourself and stay on track. A well-structured repayment plan, coupled with consistent effort, is essential for successful debt management.

Seeking Professional Guidance

If managing your debt feels overwhelming or if you're unsure about the best approach, seeking professional guidance from a financial advisor can be invaluable. A qualified financial advisor can provide personalized advice tailored to your specific financial situation, helping you develop a debt management strategy that aligns with your goals and circumstances. They can also offer valuable insights into various debt relief options and help you navigate the complexities of debt management.

Read more about Personalized Financial Wellness: Strategies for Reducing Money Stress

Hot Recommendations

- AI Driven Personalized Sleep Training for Chronic Insomnia

- AI Driven Personalization for Sustainable Stress Management

- Your Personalized Guide to Overcoming Limiting Beliefs

- Understanding Gender Dysphoria and Mental Health Support

- The Power of Advocacy: Mental Health Initiatives Reshaping Society

- Building a Personalized Self Compassion Practice for Self Worth

- The Ethics of AI in Mental Wellness: What You Need to Know

- AI Driven Insights into Your Unique Stress Triggers for Personalized Management

- Beyond Awareness: Actionable Mental Health Initiatives for Lasting Impact

- Creating a Personalized Sleep Hygiene Plan for Shift Workers