Sustainable Financial Wellness: Empowering Your Mind with Financial Peace

Building a Solid Financial Foundation: Budgeting and Beyond

Understanding Your Financial Situation

Before you can build a solid financial foundation, you need to understand your current financial situation. This involves taking a complete inventory of your assets and liabilities. This includes everything from your savings accounts and investments to your outstanding debts, like credit card balances and loans. A clear understanding of your income and expenses is also crucial. Tracking your spending habits can reveal areas where you might be overspending and identify opportunities to save.

Analyzing your financial statements, such as bank statements and credit reports, will provide a comprehensive picture of your financial health. Understanding where your money is going and how much you're earning is the first step towards building a sustainable financial future.

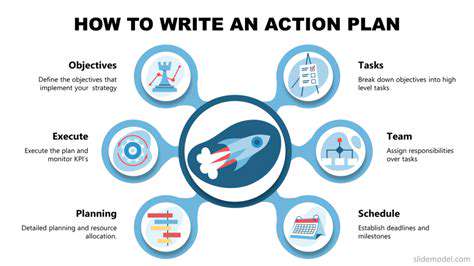

Creating a Budget

A budget is a roadmap for your finances. It outlines your income and expenses, and helps you allocate your resources effectively. Creating a realistic budget is essential for achieving your financial goals. It's a plan that helps you understand how to manage your money and avoid unnecessary spending.

There are various budgeting methods, from simple spreadsheets to sophisticated software tools. Choose the method that best suits your needs and preferences. Be sure to track your progress regularly and adjust your budget as needed. Consistency is key to building a strong financial foundation.

Saving for Emergencies

Unexpected expenses can quickly derail your financial plans. Having a dedicated emergency fund is crucial for weathering unforeseen circumstances. Aim to save enough to cover three to six months of your living expenses. This safety net will provide peace of mind and allow you to handle emergencies without resorting to high-interest debt.

Debt Management

High-interest debt can quickly accumulate and become a significant burden. Develop a strategy to manage and reduce your debt. Consider options like debt consolidation or balance transfers to lower your interest rates and make payments more manageable. Prioritize paying off high-interest debts first to minimize the overall cost of borrowing.

Investing for the Future

Investing your money wisely is essential for building wealth over time. Research different investment options, such as stocks, bonds, and mutual funds, to determine which ones align with your risk tolerance and financial goals. Start early and contribute regularly to your investments to maximize the power of compounding.

Diversifying your investments across various asset classes can help mitigate risk and potentially increase returns. Understanding the potential risks and rewards of different investment strategies is crucial for making informed decisions.

Building Credit

Maintaining a good credit score is important for accessing favorable loan terms and credit opportunities. Paying your bills on time and keeping your credit utilization low are key factors in building and maintaining a healthy credit score. Monitoring your credit report regularly can help you identify any errors and take corrective action promptly.

Seeking Professional Advice

Financial planning can be complex. Don't hesitate to seek professional advice from a qualified financial advisor. A financial advisor can provide personalized guidance and strategies tailored to your specific needs and goals. They can help you navigate complex financial situations and make informed decisions.

Professional advice can save you time and effort, and help you avoid potential pitfalls. They can help you develop a comprehensive financial plan that addresses your short-term and long-term goals.

Debt Management: Strategies for Liberation

Understanding Your Debt Landscape

Debt management isn't a one-size-fits-all solution. To effectively chart a course toward liberation, you first need a clear understanding of your current financial situation. This involves meticulous record-keeping, identifying all sources of debt – credit cards, loans, mortgages, and any outstanding balances – and assessing the interest rates and minimum payments associated with each. A comprehensive overview of your income, expenses, and savings is crucial to crafting a realistic and achievable debt reduction plan.

Analyzing your spending habits is also vital. Pinpointing areas where you can cut back on unnecessary expenses and redirect those funds toward debt repayment can significantly accelerate your progress. This might involve negotiating lower interest rates on existing loans, exploring debt consolidation options, or even making small, consistent adjustments to your daily spending routines.

Developing a Realistic Debt Repayment Plan

Once you have a thorough understanding of your debt, crafting a realistic repayment plan becomes paramount. This plan should consider your current income, expenses, and available savings. Prioritize high-interest debt, as aggressively tackling these obligations can save you significant money in interest payments over time. Consider a debt snowball or debt avalanche method, each with its own advantages, to stay motivated and on track.

Exploring Debt Consolidation Strategies

Debt consolidation involves combining multiple debts into a single loan with a potentially lower interest rate. This can simplify your financial obligations and potentially reduce your overall monthly payments. However, it's crucial to carefully weigh the pros and cons, including potential fees and the impact on your credit score. Research different consolidation options and compare interest rates and terms to determine the best fit for your financial situation.

Thorough research and comparison shopping are key to finding a consolidation strategy that aligns with your needs and budget. Different lenders have different terms, and understanding these terms is essential to making an informed decision.

Negotiating with Creditors for Favorable Terms

Don't hesitate to reach out to your creditors to discuss potential payment modifications or lower interest rates. Many creditors are willing to work with borrowers who demonstrate a commitment to repayment and a clear plan. This proactive step can significantly impact your monthly payments and accelerate your path to debt freedom. Document all communication and agreements to maintain clarity and accountability.

Building a Sustainable Financial Future

Liberation from debt is not just about paying off outstanding balances; it's about cultivating sustainable financial habits for the long term. This involves establishing a budget that prioritizes saving and investing. Developing a well-defined budget can help you identify areas where you can cut back on unnecessary expenses and redirect those funds towards savings and investments.

Building an emergency fund is also crucial for unexpected expenses. This safeguard protects you from falling back into debt during unforeseen circumstances. It provides a financial cushion for unexpected expenses, helping you maintain stability and financial freedom in the long run.

Investing for the Future: Building Financial Security

Understanding the Importance of Long-Term Investments

Investing for the future is crucial for achieving financial security and independence. It's a marathon, not a sprint, requiring patience and a long-term perspective. While short-term gains can be tempting, a well-structured investment plan focusing on the long haul is key to building wealth and reaching your financial goals, whether it's retirement, a down payment on a house, or funding your children's education.

By investing consistently over time, you harness the power of compounding returns. This means your initial investments earn interest, and those earnings also earn interest, leading to exponential growth over the long term. This principle is fundamental to building substantial wealth.

Defining Your Financial Goals

Before diving into investment strategies, clearly define your financial objectives. What do you hope to achieve with your investments? Are you saving for retirement, a down payment on a home, or funding your children's education? Clearly articulated goals provide direction and motivation, keeping you focused on your long-term financial aspirations.

Diversifying Your Investment Portfolio

Diversification is a cornerstone of successful investing. It helps mitigate risk by spreading your investments across various asset classes, such as stocks, bonds, real estate, and precious metals. This approach ensures that if one investment underperforms, others might compensate, reducing the overall impact of market fluctuations on your portfolio.

Consider the level of risk you're comfortable with and allocate your investments accordingly. A well-diversified portfolio helps you navigate market volatility and protect your capital.

Selecting Appropriate Investment Vehicles

Understanding different investment vehicles is essential for building a robust portfolio. Stocks offer the potential for high returns but also carry higher risk. Bonds provide a more stable return but with potentially lower growth. Real estate can provide both income and capital appreciation, while precious metals can serve as a hedge against inflation.

Thorough research and consulting with a financial advisor can help you determine the right mix of investments for your individual circumstances and risk tolerance.

Developing a Realistic Budget

A meticulously crafted budget is an indispensable tool for effective investment planning. Tracking your income and expenses allows you to identify areas where you can save and allocate funds towards your investment goals. A well-defined budget ensures that you are effectively managing your finances and making informed decisions about where your money goes.

Managing Risk and Reward

Understanding the balance between risk and reward is crucial in investment strategy. Higher-risk investments often have the potential for higher returns, but also carry the possibility of significant losses. Lower-risk investments offer more stability but typically produce more modest returns. Finding the right balance between risk and reward is critical for long-term investment success.

A key element of effective risk management is setting realistic expectations and having a plan for navigating potential market downturns.

Seeking Professional Financial Advice

Seeking guidance from a qualified financial advisor can significantly enhance your investment journey. Their expertise can help you develop a personalized investment plan that aligns with your goals and risk tolerance. Experienced professionals can provide valuable insights into market trends and help you make informed investment decisions.

Don't hesitate to leverage the knowledge and experience of financial advisors to build a stronger foundation for your financial future. They can provide objective advice and support you in navigating the complexities of the investment world.

Read more about Sustainable Financial Wellness: Empowering Your Mind with Financial Peace

Hot Recommendations

- AI Driven Personalized Sleep Training for Chronic Insomnia

- AI Driven Personalization for Sustainable Stress Management

- Your Personalized Guide to Overcoming Limiting Beliefs

- Understanding Gender Dysphoria and Mental Health Support

- The Power of Advocacy: Mental Health Initiatives Reshaping Society

- Building a Personalized Self Compassion Practice for Self Worth

- The Ethics of AI in Mental Wellness: What You Need to Know

- AI Driven Insights into Your Unique Stress Triggers for Personalized Management

- Beyond Awareness: Actionable Mental Health Initiatives for Lasting Impact

- Creating a Personalized Sleep Hygiene Plan for Shift Workers