Personalized Financial Wellness for Entrepreneurs: Reducing Stress and Debt

Creating a Realistic Budget and Cash Flow Projection

Understanding Your Income and Expenses

A crucial first step in creating a realistic budget and cash flow projection is a thorough understanding of your income sources and expenses. This involves meticulously tracking every dollar coming in and going out for a period of at least a month. Detailed records help you identify recurring costs, occasional expenses, and potential areas for savings. This detailed analysis will serve as the foundation for your budget, allowing you to allocate funds effectively and realistically anticipate future financial needs and obligations.

Categorizing expenses is vital. Separate fixed expenses like rent or mortgage, utilities, and loan repayments from variable expenses like groceries, entertainment, and dining out. This categorization will assist in identifying areas where you might be able to cut back or find ways to reduce variable expenses through smart choices. Understanding your spending habits is a key component of effective financial planning.

Developing a Realistic Budget

Once you've documented your income and expenses, you can begin constructing a realistic budget. This involves allocating your income to different categories based on your priorities and financial goals. Don't aim for unrealistic savings targets; instead, focus on manageable, sustainable reductions in spending. A budget should be a living document, not a rigid constraint. You can adapt it as your circumstances change and your priorities evolve.

Consider using budgeting tools or apps to help you visualize your spending patterns and make adjustments as needed. These tools often offer insightful features that help you understand where your money is going and identify potential areas for saving. A well-structured budget is a key to achieving financial stability and reducing unnecessary stress.

Projecting Future Cash Flow

A cash flow projection extends beyond the immediate budget by anticipating income and expenses over a specific timeframe, often a year or more. It's more than just predicting income; it incorporates anticipated expenses, investments, and other financial commitments. This forward-looking approach helps you prepare for potential financial shocks or opportunities and allows for adjustments as needed.

Anticipating future expenses, such as planned home renovations or major purchases, is integral to accurate cash flow projections. This forward-thinking approach enables you to make informed decisions about saving, investing, and borrowing to meet your financial goals in the long term. By projecting your cash flow, you can identify potential shortfalls and plan for them proactively.

Implementing and Monitoring Your Plan

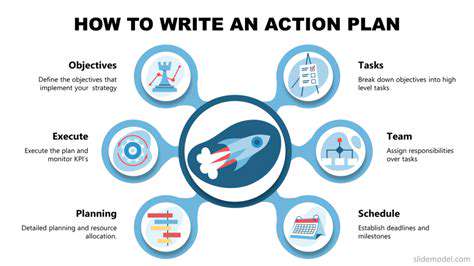

Creating a budget and cash flow projection is only the first step; the key to success lies in consistently implementing and monitoring your plan. Regularly reviewing your progress against your projections is crucial. Are you meeting your savings goals? Are there areas where you can improve your spending habits? Regular evaluations allow for necessary adjustments to ensure you stay on track. This ongoing monitoring process allows for a more personalized approach to budgeting and enables you to adapt to changing circumstances.

Adaptability is key. Life throws curveballs, and your budget needs to be flexible enough to accommodate unexpected events or opportunities. A well-maintained budget, regularly monitored and adjusted, is a cornerstone of financial well-being and helps in achieving long-term financial goals. Be prepared to revisit and refine your budget periodically to ensure it remains relevant and effective in meeting your financial needs.

Debt Management Strategies for Entrepreneurs

Understanding Your Debt

Effectively managing debt requires a deep understanding of your current financial situation. This includes knowing the specifics of each debt obligation, such as the principal amount, interest rate, minimum payment, and due dates. A thorough evaluation is crucial to developing a sustainable debt reduction plan. A comprehensive understanding of your debt load is the first step toward achieving financial freedom.

Identifying all sources of debt is paramount to creating a realistic budget. This includes not only credit card debt but also outstanding loans, mortgages, and any other financial obligations. Failure to account for all these debts can lead to inaccurate budgeting and hinder your progress in managing your finances effectively.

Creating a Budget and Tracking Expenses

A well-structured budget is the cornerstone of any successful debt management strategy. It allows you to meticulously track your income and expenses, identifying areas where you can cut back and allocate more funds towards debt repayment. Creating a detailed budget helps you visualize your financial situation and pinpoint areas where you can make necessary adjustments to achieve your financial goals.

Tracking your spending is crucial for recognizing unnecessary expenses and identifying opportunities to save. Detailed records of your income and expenses are essential for creating a realistic budget and making informed financial decisions. Understanding your spending habits empowers you to make conscious choices about how you allocate your funds.

Regular monitoring of your budget allows you to identify potential issues and make necessary course corrections. This proactive approach helps you stay on track and maintain financial stability, ensuring that your debt management plan remains effective over time.

Debt Consolidation and Refinancing

Debt consolidation involves combining multiple debts into a single loan with a potentially lower interest rate. This can simplify your financial obligations and potentially reduce your overall monthly payments. However, it's essential to carefully assess the terms of any consolidation loan to avoid accumulating additional debt or facing higher interest charges in the long run. This strategy can be beneficial in simplifying your financial obligations and potentially lowering your monthly payments.

Refinancing, on the other hand, involves replacing an existing loan with a new one with more favorable terms. This could potentially reduce your interest rate, lower your monthly payments, or shorten the loan's term. Before pursuing refinancing, compare offers from various lenders to secure the best possible terms for your situation. It's important to compare offers from different lenders to ensure you're getting the most advantageous terms.

Negotiating with Creditors and Utilizing Debt Management Plans

Sometimes, directly negotiating with creditors can yield positive results. This may involve requesting a lower interest rate, a longer repayment period, or a temporary reduction in monthly payments. While not always successful, these efforts can be valuable in managing your debt effectively. Communicating openly with creditors is an important step in managing your debt effectively.

Debt management plans (DMPs) are structured programs offered by credit counseling agencies. They provide a framework for consolidating and managing debt while working with creditors. These plans often involve creating a budget, negotiating with creditors, and developing a repayment strategy. They often involve an impartial third party mediator that can help you reach an agreement with your creditors.

Read more about Personalized Financial Wellness for Entrepreneurs: Reducing Stress and Debt

Hot Recommendations

- AI Driven Personalized Sleep Training for Chronic Insomnia

- AI Driven Personalization for Sustainable Stress Management

- Your Personalized Guide to Overcoming Limiting Beliefs

- Understanding Gender Dysphoria and Mental Health Support

- The Power of Advocacy: Mental Health Initiatives Reshaping Society

- Building a Personalized Self Compassion Practice for Self Worth

- The Ethics of AI in Mental Wellness: What You Need to Know

- AI Driven Insights into Your Unique Stress Triggers for Personalized Management

- Beyond Awareness: Actionable Mental Health Initiatives for Lasting Impact

- Creating a Personalized Sleep Hygiene Plan for Shift Workers