Your AI Guide to Financial Wellness and Stress Reduction

Understanding the Root Causes

Money-related stress extends beyond account balances; it's an intricate emotional reaction influenced by various elements. These concerns frequently originate from previous encounters, including financial struggles or perceived shortcomings. Societal norms and expectations also play a role, as people often feel pressured to uphold particular lifestyles or reach specific milestones, resulting in stress and self-doubt.

Present circumstances like employment uncertainty, surprise costs, or growing liabilities can further intensify these worries. The possibility of financial instability can create an ongoing cycle of apprehension and tension.

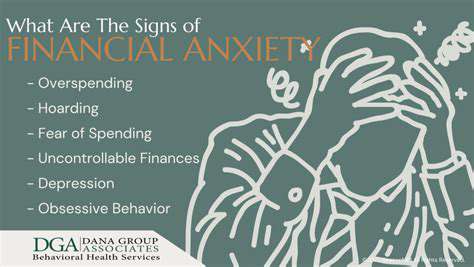

Recognizing Common Indicators

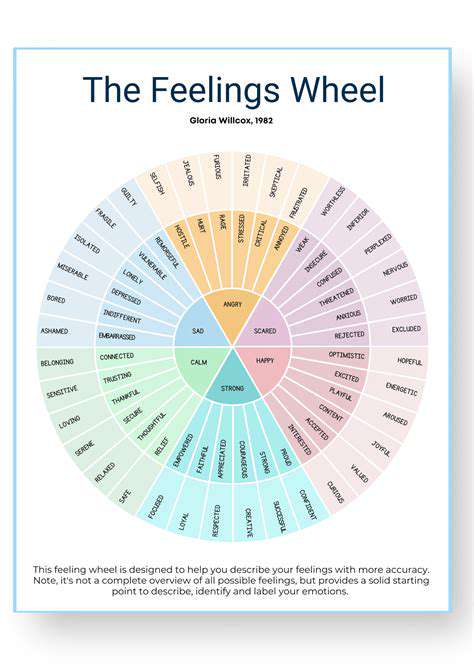

Financial stress manifests in numerous ways. People might endure continuous concern, nervousness, or even sudden episodes of panic regarding monetary issues. This can result in sleep disturbances, reduced appetite, and a pervasive feeling of discomfort. Additionally, many experience diminished concentration that affects both professional and personal responsibilities.

Identifying these signs as potential markers of financial stress is essential for obtaining proper assistance.

The Effect on Psychological Health

Continuous financial worry can severely impact mental health. The prolonged stress linked to these concerns may lead to various psychological conditions, including depressive disorders, exhaustion, and even addictive behaviors. The perpetual concern about finances can dramatically reduce life satisfaction and foster feelings of despair.

Addressing financial stress early is vital to prevent it from worsening and negatively influencing other life areas.

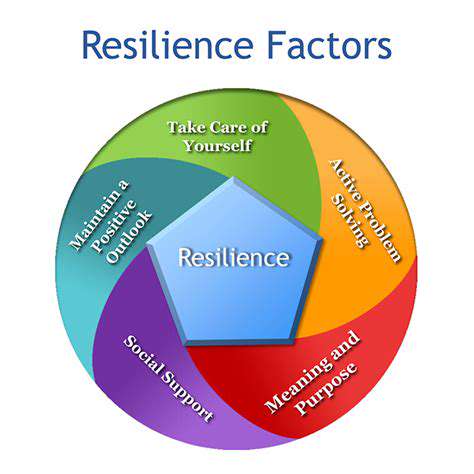

Effective Coping Techniques

Several practical approaches can help manage financial stress. Establishing a practical spending plan and carefully monitoring expenditures can offer clarity and command over financial circumstances. Formulating a strategy for liability reduction and investigating available financial support options can relieve the burden of excessive debt.

Consulting with financial specialists or qualified counselors can yield valuable perspectives and assistance for navigating complicated financial situations. These methods support proactive management and reduction of monetary concerns.

Establishing Solid Financial Groundwork

Creating a stable financial base is fundamental for alleviating money-related stress. Developing sound financial practices, including budget creation, regular saving, and prudent investing, can foster security and confidence. Mastering and applying these abilities enables individuals to handle their finances competently and assuredly.

Financial education serves as a critical instrument for building this foundation. These resources assist people in making knowledgeable choices while avoiding impulsive financial decisions that might worsen anxiety.

Obtaining Professional Support

When financial stress becomes unmanageable or substantially disrupts daily functioning, professional intervention is advisable. Therapists focusing on financial stress or stress reduction can offer customized assistance and techniques for addressing the emotional and behavioral components of these challenges. Expert advice provides a secure environment to explore the root causes of financial stress and cultivate healthy coping strategies.

Therapeutic professionals can help recognize detrimental thought processes and develop more balanced views of financial matters. They assist in creating personalized financial blueprints and effective approaches to manage stress, enhance decision-making, and improve overall wellness.

Technology-Enhanced Budget Management: Optimizing Spending Practices

The Role of Modern Technology in Financial Planning

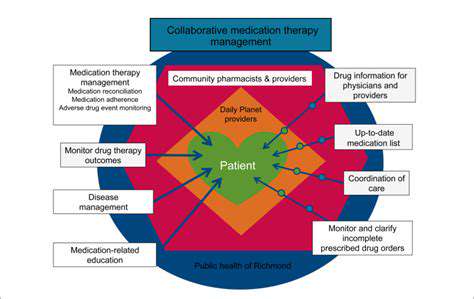

Advanced technological solutions are reshaping multiple life domains, including personal finance. Contemporary budgeting tools utilize complex computational methods to examine spending behaviors, detect improvement opportunities, and recommend financial adjustments. This intelligent methodology helps users gain financial control and improve economic stability. By automating processes and delivering customized insights, technology substantially simplifies budget administration, making it more accessible and efficient.

Streamlining Financial Tracking

A primary advantage of technology-enhanced budget management is process automation. These solutions can automatically record earnings and expenditures, classify transactions, and present a transparent overview of spending patterns. This removes the manual work associated with conventional budgeting techniques, saving time and minimizing mistakes. Additionally, these tools can automatically modify budgets in response to life changes like salary modifications or emergency costs.

Envision a system that accurately records every transaction, immediately categorizes it, and generates comprehensive spending reports. This represents the capability of automated financial tracking, transforming how people approach money management.

Customized Financial Analysis

Advanced algorithms evaluate individual spending habits to generate personalized financial assessments. This includes spotting trends, indicating potential overspending areas, and proposing budget optimization methods. These tailored suggestions enable better decision-making and financial strategy customization according to personal requirements and aspirations. The technology can also detect possible financial hazards and provide advance notifications, allowing preventive actions.

Forward-Looking Financial Projections

Modern tools offer predictive capabilities that surpass current spending analysis. They can estimate future costs, helping prepare for anticipated bills or events. This anticipatory method facilitates superior financial preparation, enabling savings for significant purchases, effective debt handling, and informed future financial choices. Predictive budgeting helps foresee difficulties and capitalize on opportunities, aligning financial activities with long-range goals.

Detecting and Controlling Excessive Spending

Modern financial tools excel at recognizing overspending patterns. By reviewing transaction history, these solutions can identify budget overages, flag repetitive purchases, highlight non-essential expenses, and recommend spending reductions in problematic areas. This proactive strategy supports mindful spending decisions, leading to improved financial control and increased savings.

Compatibility with Current Financial Systems

Technology-enhanced budget tools typically integrate smoothly with existing financial platforms. This compatibility creates a unified workflow, combining financial information for a complete picture of economic health. The straightforward integration simplifies adoption of these tools while maximizing automated analysis benefits. System compatibility reduces implementation challenges and ensures uninterrupted data transfer.

Enhancing Financial Knowledge

Beyond basic budget management, these tools improve financial understanding. They offer clear explanations of spending behaviors, provide customized improvement suggestions, and supply knowledge for informed economic decisions. This heightened awareness promotes deeper financial comprehension, empowering users to direct their financial futures. Modern tools contribute to overall financial wellness by simplifying complex economic concepts.

Immersive training simulations transform education by creating ultra-realistic situations impossible to achieve through conventional techniques. Imagine practicing complex medical procedures in virtual surgical suites, perfecting high-stakes negotiations, or exploring dangerous locations without real-world risks. These virtual environments allow unlimited repetition in safe settings, significantly enhancing skill acquisition.

Technology-Supported Debt Solutions: Navigating Toward Economic Independence

Comprehensive Debt Evaluation

Modern analytical tools can thoroughly assess financial information, including earnings, expenditures, and existing liabilities, to deliver a complete picture of current economic status. This in-depth evaluation surpasses basic budgeting applications, uncovering patterns and potential concerns that might otherwise remain hidden. This comprehensive understanding is essential for formulating successful debt resolution approaches.

By detecting trends and relationships, analytical tools provide awareness of potential overspending or resource allocation challenges. This preventive method can help avoid additional debt accumulation and establish a more stable financial path.

Customized Liability Reduction Plans

Advanced platforms can design personalized debt repayment strategies based on individual economic circumstances. Elements like income level, debt categories, and interest rates are incorporated to create optimized plans for efficient debt elimination. This tailored method substantially increases the probability of successful debt reduction compared to generic approaches.

Automated Financial Monitoring

Modern solutions can automate income and expense tracking, offering real-time financial status updates. This automated monitoring helps identify potential spending reductions and more effective fund allocation toward debt repayment. Automated financial tools can dramatically decrease the time and energy needed for financial management.

Forecasting for Debt Resolution

Analytical tools can utilize historical information and current economic trends to predict potential future financial scenarios. This forecasting capability helps anticipate possible obstacles and modify debt management tactics accordingly. This proactive perspective can greatly enhance long-term debt management effectiveness.

Debt Restructuring Suggestions

Analytical tools can evaluate the practicality of debt consolidation or refinancing alternatives, considering credit ratings, interest rates, and other relevant financial indicators. This assessment helps identify optimal options for reducing overall debt load and interest payments. By examining numerous possibilities, these tools can recommend ideal strategies for unique situations.

Enhanced Financial Visibility

Advanced platforms frequently provide detailed progress reports and visual representations of financial improvement, simplifying debt reduction tracking. This transparency promotes responsibility and motivation, helping maintain progress toward financial objectives. Clear visibility and accountability represent crucial elements of any effective debt resolution strategy. This improved financial awareness supports better economic decision-making moving forward.

Read more about Your AI Guide to Financial Wellness and Stress Reduction

Hot Recommendations

- AI Driven Personalized Sleep Training for Chronic Insomnia

- AI Driven Personalization for Sustainable Stress Management

- Your Personalized Guide to Overcoming Limiting Beliefs

- Understanding Gender Dysphoria and Mental Health Support

- The Power of Advocacy: Mental Health Initiatives Reshaping Society

- Building a Personalized Self Compassion Practice for Self Worth

- The Ethics of AI in Mental Wellness: What You Need to Know

- AI Driven Insights into Your Unique Stress Triggers for Personalized Management

- Beyond Awareness: Actionable Mental Health Initiatives for Lasting Impact

- Creating a Personalized Sleep Hygiene Plan for Shift Workers